Exness offers competitive spreads, representing the difference between the buying and selling price of a trading pair. For the Standard accounts, the minimum spread starts from 0.3 pips. You can use near-zero spreads for Raw Spread accounts. It’s all about the account you have opened and market conditions. Tight spreads play an important role in your probable cost reduction and, therefore, are so appreciated among traders in search of efficient pricing in Exness.

What is the Spread of Exness?

Spreads on Exness refer to the difference between sell and buy prices of a trading instrument. It’s a kind of commission that traders pay for opening a position. Starting from 0.3 pips on Standard accounts, spreads by Raw Spread accounts can be as close to zero as possible. The spreads depend on the conditions of the market: everything is influenced by the level of liquidity and the volatility of the market. Lower spreads mean that traders can get in and out of positions with lower costs, especially when it comes to frequent trading.

Why It Matters in Forex Trading

Spreads are vital in determining your trade’s overall cost, mainly for a day trader or scalper who opens and closes trades more than a couple of times in a day. The tighter the spread, the lesser the cost per trade will be, which may decide profitability in the longer run. Exness grants competitive spreads that can help traders maximize their returns. That makes the Exness platform quite alluring to those who focus on keeping trading expenses at a minimum. Understanding how the spreads may affect your trade can be the key to a good choice of account type and trading strategy, especially if you are planning to make profits in the short run.

Types of Spreads on Exness

The forex spread is the difference between the bid, or selling, and ask, or buying, prices of a currency pair. This price difference essentially equates to the cost of trading that also serves as the main source of brokers’ revenues. At Exness, it’s very important to comprehend what kind of spread types are offered for successful trading.

Fixed Spreads

The fixed spreads do not change due to any kind of market conditions. They become predictable transaction costs for traders, which is welcome in times of high market volatility. However, truly fixed spreads are seldom found in retail trading because they do not constitute the ‘real’ market. In any financial market, spreads would need to change-even slightly-depending on a particular broker’s order book. For instance, when major news events drive the price of an asset to fluctuate rapidly with high volume, pending orders may get triggered within a short time repeatedly. It is at this juncture that the broker will increase protection against risk for both himself and the client by widening the spread.

Floating Spreads

Floating, or dynamic, spreads move along with market conditions: volatility, liquidity, and news events. They can dramatically range from less than a pip in quiet market sessions to dozens of pips during key news or high-volume periods. Floating spreads can offer lower costs during stable market conditions but may widen a lot during volatility. Exness offers most instruments as floating spreads. In turn, for a number of currency pairs they offer stable spreads that stay at almost the same value the most part of time. This gives traders predictable costs.

How Spreads Affect Trading Profitability

The size of a spread has a great impact on trading cost and, consequently, profitability. Whenever you enter into a trade, your cost is essentially the spread. The smaller it is, the less you need the market to move in your favor in order for you to cover that cost and turn a profit. Hence, selecting a broker with tight spreads, such as Exness, can make a great deal of difference to cost-effective trading.

Impact of Spread Size on Trading Outcomes

The size of the spread may directly impact your trading outcome, especially if you are into some very short-term strategy, like scalping or day trading. With wider spreads, it takes longer for the trades to become profitable because you need a greater amount of price movement to cover the cost. In a volatile market, the spreads go up and may raise your costs. You really have to pay attention to the spread during key news events, or you may receive an unplanned loss.

How to Calculate the Cost of Spreads in Trades

Understanding spreads can be all that stands between good and poor trading. The following will just show how one can calculate the cost of a spread.

- Identify the Size: From the bid to the asking price, identify the quoted amount.

- Times Lot Size: Supposing the spread is 2 pips, and you open a trade with a standard lot of 100,000 units, the cost will be $20.

- Convert to Account Currency: If trading a currency pair different from your account currency, convert the spread cost into your account’s currency.

These simple calculations can give you an estimate of the cost of each of your trades, which will help you better manage your costs. These spread costs will keep traders-grounded regarding targets of profit and manage risk more appropriately.

Trading Strategies with Exness Spreads

Understanding how spreads work when trading with Exness can significantly help and improve your trading strategy. As a brokerage firm offering fixed and variable spreads, traders are allowed to adapt their techniques to current market conditions. With Exness offering competitive spreads, traders can optimize their strategies in order to pursue increased profitability.

Scalping with Low Spreads

Scalping means trading in a very short term, usually within minutes, in order to gain profits from minor price movements. In such trading, low spreads are significant because high values would cut into the profits. Exness maintains tight spreads, especially for major forex pairs, which would certainly be suitable for scalpers. Scalpers should therefore target sessions with high liquidity, like London or New York market hours, when the spread is at its minimal to maximize their return.

Swing Trading with Variable Spreads

Swing trading is a longer-term strategy that takes several days, trying to catch the market’s swings. Here, traders can enjoy variable spreads with Exness since this brokerage company changes them depending on the situation in the market. While spreads are likely to widen during a period of high volatility, this factor has less influence on swing traders due to a longer holding period and larger price targets. Variable spreads allow swing traders to profit from wider market movements safely and without being overly concerned when slight changes occur in the spread costs.

Factors Influencing the Size of Spreads on Exness

The spread on Exness may be affected by several factors. It is determined by market conditions, trading volume, and also the type of account being used. Each of these components needs to be recognized for the trader to minimize his costs effectively, hence arriving at a better decision in trading. The higher the spread is, the lower the profit, especially when the trader conducts frequent trading.

Market Volatility

During periods of high market volatility, the spread starts to widen. This is due to more uncertainty in the market, making it harder for a broker to correctly value an instrument. In other words, any event that may result in fast price oscillations, like economic announcements and political news, can cause sudden market movement. Traders need to know when such periods occur as this may impact the price of entry and exit from trades.

Trading Volume

Greater trading volume typically results in smaller spreads. In other words, if more traders are buying and selling a certain asset, then there is more liquidity in the market, and the spread would remain narrow. The EUR/USD, for instance, is one of the major forex pairs with low spreads due to its high volume of trade. Less well-known pairs, on the other hand, may have wider spreads since demand is lower.

Types of Accounts

Exness offers many account types, each with different conditions regarding spreads. For example, Standard accounts might have a little higher spread than Raw Spread or Zero accounts. Traders who want to have lower spreads will be benefited by selecting an appropriate type of account based on their trading strategy. Account features should be verified before opening the account, which helps in reducing the cost while trading.

Exness Spread Comparison with Other Brokers

Exness is well-known for its competitive spreads among other brokers in the forex market. The spread is the difference between buying and selling prices of a currency pair, which is one of the major costs of trading. With lower spreads, your trading costs go down, raising thereby your profitability over time. Exness pays a lot of attention to tight spreads on major currency pairs.

Competitive Spreads in Forex Trading

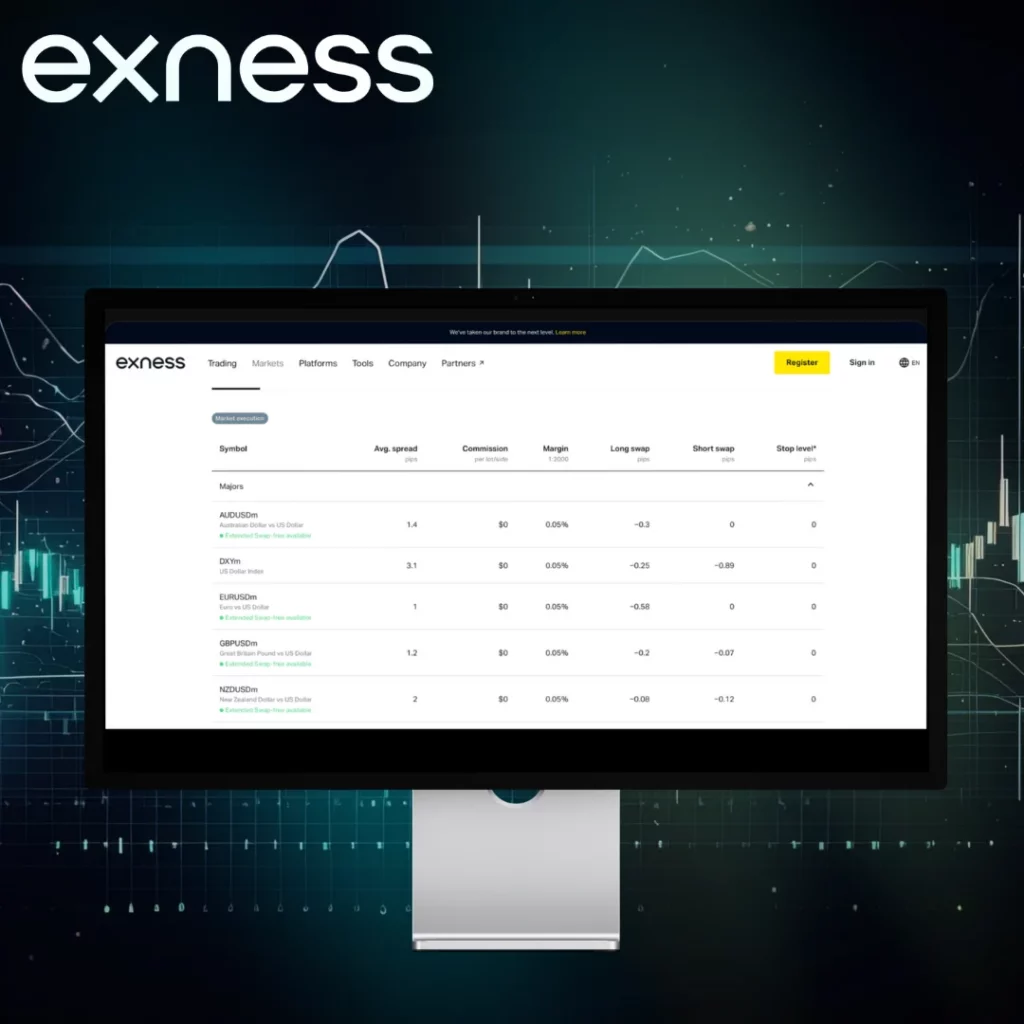

Exness works towards trying to keep spreads as low as possible to accommodate the needs of those traders who would like to execute a trade at probably the lowest price. A breakup is given below:

- EUR/USD: The spreads start from as low as 0.1 pips.

- GBP/USD: The average spread is around 0.3 pips.

- USD/JPY: The spread generally ranges from 0.2 pips.

These tight spreads can save the traders some money, especially if one is making frequent trades. It goes without saying that choosing a broker like Exness who offers lower spreads can assure greater profitability.

Choosing a low-spread broker like Exness will make much difference for any trader in overall profitability. Supposing you have large volumes of trade, you will have substantial cost savings from even small differences in spreads. You can also have access to floating and raw spread accounts with Exness, which gives further flexibility dependent on the trading strategy.