Exness promotes clarity in its trading conditions; however, it is beneficial to know these costs in detail for efficient and professional management of trading costs. It charges majorly on three types of costs: spread, commission, and swap charges. They differ depending on account type, asset classes, and lots of trade. Being informed about the same ensures that you prepare your trade to maximum benefit. Exness is relentless in maintaining them at the minimum possible, thus competing among both new and professional traders.

Exness Fees and Charges

Exness charges most of its traders through spreads, commissions, and swap fees. Spreads are the differences between the buying and selling prices, and they could be different depending on the asset but also depending on some account types. Some of the account types also have commissions, especially for those accounts that offer raw spreads. Swap fees may be levied against your account if you hold positions overnight. However, Exness aims to maintain these at the lowest to help you always keep your costs as low as possible. Knowing these well will help you in determining a suitable trading strategy.

Types of Fees on Exness

Exness has various different fees that are charged to traders depending on the type of account and the services availed. These include trading fees such as spread, commissions, and swap rates, and non-trading fees that include withdrawal charges and inactivity fees. It is important for a trader to understand these fees to handle his business more adequately.

Exness Trading Fees

The primary trading fees with Exness are the spreads, commissions, and swap rates that are attached to the trades you will be placing. A better understanding of such costs can help traders strategize and cut down on expenses.

Spread Explanation

The difference between the buying and selling price of the asset is called spreads. The type of spread varies depending on the market conditions and account type; some accounts can have lower spreads, thus being suitable for high-volume traders.

Swap Rates

Swap rates or overnight fees apply when you keep your positions open after a specific time. This is the fee that is different from the asset you trade, and which can either be positive or negative depending on the interest rate differential between the two currencies.

Trade Commissions

Exness charges a commission on a select few account types, usually those with raw spreads. This is typically per lot traded, and it may vary depending on the asset. Commissions charges are essential to understand in order to understand how much trading will cost.

Exness Non-Trading Fees

Apart from the trading-related fees, there are Exness non-trading fees, which include fees for withdrawal and inactivity fees. These are other crucial fees when one is not actively trading or withdrawing frequently.

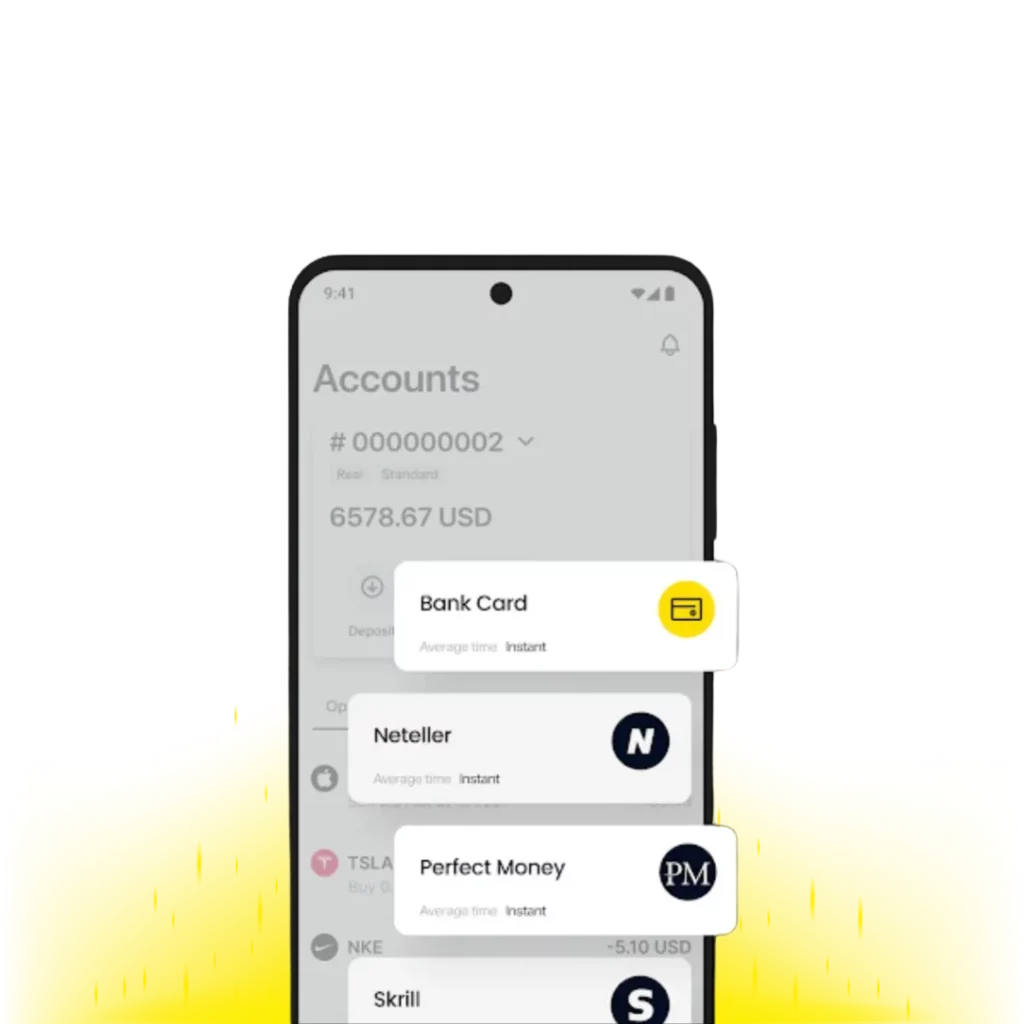

Deposit and Withdrawal Fees

Most of the deposits and withdrawals with Exness are free, although some of the methods may have third-party fees. That is where verifying the possibility of any charges becomes highly important before laying hands on one or another transaction. You would not like unexpected expenses.

Inactivity Fees

No inactivity fees are charged by Exness. In this respect, it is all right to leave your account open even without trading on it for a pretty long period of time without extra overpayments.

Comparison of Exness Fees with Other Brokers

Perhaps the most important factor in broker selection pertains to fees. On this particular factor, Exness happens to stand out from among its peers by offering very competitive pricing. This is because traders stand to benefit from lower spreads, very low commissions, and zero hidden costs. In the process, Exness makes an excellent choice for the trader looking to maximize profits without putting much into unnecessary overheads.

How Exness Fees Stack Up Against Competitors

Exness has several advantages over other brokers:

- No Deposit and Withdrawal Fees: Unlike many brokers, Exness does not charge fees for deposits or withdrawals.

- Low Spreads: Exness offers tight spreads, especially on accounts like Raw Spread, reducing trading costs.

- No Inactivity Fees: Traders don’t have to worry about extra charges if they stop trading for a while.

- Flexible Account Types: Options for both beginners and advanced traders with tailored fee structures.

These features make Exness an affordable and practical choice for traders who want to reduce their trading expenses while still accessing professional tools.

Strategies to Minimize Commission Costs When Trading on Exness

Traders will, in particular, seek to minimize the costs of trading in an attempt to gain maximum returns from Exness. The commission and other fees could be reduced by traders through the development of smart strategies. This would build up effective savings, but it would also mean effectiveness in the overall circle of trading, which applies to those who deal more frequently.

Tips for Reducing Trading Fees

- Choose the Right Account: Opt for accounts like Raw Spread or Zero Spread, which offer lower trading fees.

- Trade During Low-Spread Hours: Spreads can vary throughout the day. Trading during periods of low market volatility can reduce costs.

- Use Limit Orders: These can help avoid paying extra spreads, especially during volatile market conditions.

- Avoid Frequent Small Trades: Accumulating small trades can increase fees. Focus on making fewer, well-planned trades to save on commissions.

By applying these tips, traders can lower their expenses and keep more of their profits.

Leverage and Risk Management

Remember that leverage serves to increase your buying power, but it also increases risk. Apply leverage judiciously in order to keep commission costs at a minimum. Use leverage only in those cases when you have a very strong strategy with a very strong risk management plan. Always monitor your positions and adjust the leverage settings to how much risk you are prepared and able to sustain. When properly managed, there is less chance for unexpected losses to occur, yet still manage to realize market opportunities as they unfold.

Commission Transparency and Fair Trading Conditions at Exness

Exness works at clarity and fairness of trading conditions. First of all, they try to be as transparent as possible about all fees and commissions. As soon as this information is provided, it is clearly reflected in the system of the trading platform, where a trader can consider in advance how much his trade might cost. Such openness allows traders to plan their actions with real calculations of costs and trust them.

How Exness Ensures Transparent Commission Structures

Exness maintains clear fee structures to help traders make informed decisions.

- Real-Time Fee Information: All commissions are displayed in real-time, allowing traders to see costs immediately.

- No Hidden Charges: Exness is upfront about all fees, avoiding unexpected costs.

- Account Comparisons: Detailed breakdowns of fees for different account types help users choose the best fit for their needs.

- Regular Updates: Exness updates traders about any changes in fees, ensuring transparency.

This straightforward approach helps traders focus on their trading strategies without worrying about unclear costs. Always keep in mind the review of fee details before opting for a specific account type. Understanding these charges will help you realize maximum profit. In the case of Exness, traders can maximize this transparent system to manage their funds better in enhancing their respective trading performance.

How Commissions Affect Overall Exness Trading Profitability

Commissions directly eat into your profits of trading because they are deducted from every trade. The more frequent your trading, the quicker these can add up, taking from your bottom line. It goes without saying that this means a lot to day traders and scalpers since they set up a large number of trades. Knowing how commissions work informs you on better ways of avoiding what could be considered as unnecessary costs that reduce your profit margins.

Impact of Fees on your Trading Performance

Fees can affect your trading results in the following ways:

- Reduced Profits: High commissions cut into your earnings, especially on smaller trades.

- Frequent Trading Costs: For traders who make multiple trades daily, commissions can quickly add up.

- Long-Term Investments: Even for long-term trades, swap fees (overnight charges) can affect your returns.

- Spreads and Slippage: Wider spreads during volatile markets can increase your costs, reducing profitability.

By being aware of these impacts, traders can make informed decisions on which trades to execute and when.

Managing Fees to Maximize Returns

Being a very frequent trader, open accounts that offer lower commissions. Arrange your trade to avoid swap fees by closing positions before overnight charges are incurred. Using trading strategies focused on fewer, higher-quality trades is also a way to minimize costs. Keep examining regular fee reports so that you can see how they reduce your performance and take action appropriately to reconsider your trading approach.